This post was published in June 2009 under the name The Fifth Problem: Peak Capital.

What's happening here? The GPS system is a pinnacle of modern technology, a demonstration that the thing we call "progress" exists. If you have a car navigator, the idea of going back to clumsy printed maps just seems impossible. And that is just one of the many uses of the GPS system. How come that we left such an important system degrade? How can it be that someone forgot that satellites need to be replaced after a while?

The degradation of the GPS system may be attributed to mistakes, incompetence, bureaucracy or even conspiracies. But the problem may lie at a much deeper level. It may be a symptom of the degradation of the whole economy. But why is this happening? People mention evil banking practices, speculation, subprimes, terrorism, and what you have. But, with so many things going on at the same time, what is really the origin of the problems and what is just a consequence of other factors? To find an answer, you need to understand how the world's economic system works. One of the first attempts to do that in a comprehensive way was the 1972 report to the Club of Rome known as "The Limits to Growth" (LTG).

The LTG study was based on a rather complex model which, however, can be summarized in terms of five main elements, as you see in the figure at the beginning of this post. The five elements are 1) population, 2) mineral resources, 3) agricultural resources, 4) pollution and 5) capital investments. This is just one of the many ways to build such a model. Other choices are possible, but the LTG model, improved over the years, is a good way to capture the essential elements of the world's economy. Despite the persistent legend that the LTG study was "wrong"; the results of the study have been found to be remarkably accurate.

None of the five elements of the model is a problem in itself. But each one can become a problem. In that case, we speak of 1) overpopulation, 2) mineral depletion, 3) famine, 4) ecosystem collapse and 5) economic decline. Often, these five problems are considered as if they were independent from each other. People tend to attribute all what is going on to a single problem: peak oil, climate change, overpopulation, and so on. In particular, economists tend to see the economy as independent from the availability of natural resources. Of course, this cannot be true and in a "dynamic" model, such as the LTG one, all the elements of the economic system interact with each other; either reinforcing each other (positive feedback) or weakening each other (negative feedback). To understand how the economy behaves as the natural resources are exploited (and overexploited) it is important to consider the role of the "capital" parameter. The behavior of the capital stock directly affects industrial production and other parameters which are counted as part of economic indicators such as the gross domestic product (GDP).

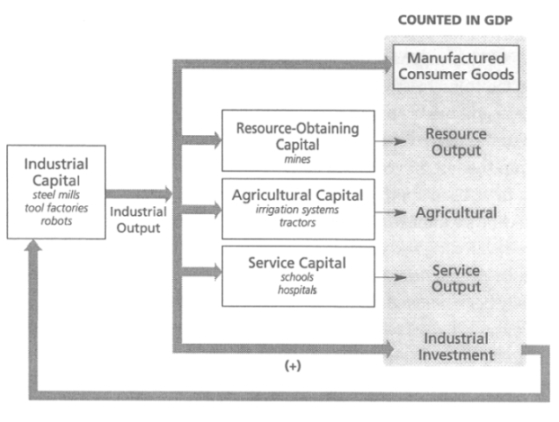

In the LTG world model, "capital" is created by investments generated by industrial activity. Capital is assumed to decay at a rate proportional to the amount of existing capital. This is called obsolescence or, sometimes, depreciation. To keep capital growing, or at least not disappearing, investments need to be larger than, or as large as, depreciation. Since investments depend on the availability of natural resources, the buildup (or the dissipation) of the capital stock depend on the progressive depletion of these resources. In the original LTG model of 1972, there were three kinds of capital stocks considered: industrial capital (factories, machines, etc.), service capital (schools, bridges, hospitals, etc.) and agricultural capital (farms, land, machinery, etc.). In the latest version (2004), industrial capital and mining capital are considered separately, as you see in the following figure ( from the synopsis of the 30 year update of LTG). Note how the "capital" parameter (in its various forms) affects the parameters which determine the GDP.

Here is a very clear description of how capital interacts with the other elements of the world model in a synopsis written in 1972 by the authors of the LTG report:

The industrial capital stock grows to a level that requires an enormous input of resources. In the very process of that growth it depletes a large fraction of the resource reserves available. As resource prices rise and mines are depleted, more and more capital must be used for obtaining resources, leaving less to be invested for future growth. Finally investment cannot keep up with depreciation, and the industrial base collapses, taking with it the service and agricultural systems, which have become dependent on industrial inputs.

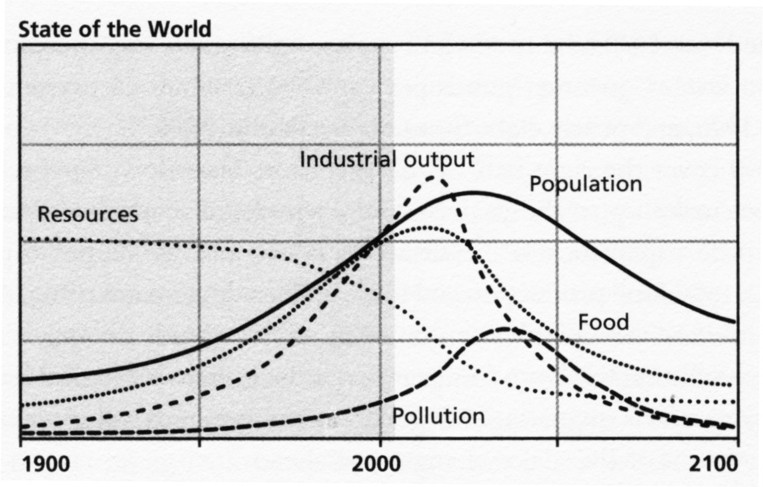

Here are the results of these interactions, expressed in graphical form as what is called the "standard run" or "base case model" of the LTG study (from the 2004 edition)

In the graph, you don't see the "capital" parameter plotted. However, industrial capital follows the same curve of industrial production. The other forms of capital have a similar behavior. All reach a maximum level and then decline, carrying the whole economy down with them. Overall, it is "peak capital."

When do we expect peak capital to occur? According to the "standard run" of the LTG report, it may arrive during the first two decades of the century. It may very well be that much of what we are seeing now is a symptom of peak capital approaching: airports, roads, bridges, dikes, dams, and about everything that goes under the name of "infrastructure" are decaying everywhere in the world. The whole economic system is becoming unable to maintain the level of complexity that it had reached just a few decades ago.

So, the degradation of the world' GPS system is not something unexpected, nor it is unrelated to such problems as peak oil or the depletion of mineral resources. It is just another kind of peak: "peak capital." Maybe GAO has been too pessimistic; maybe we'll decide that the GPS system is so important that we can't let it decay. But, in any case, it is a sign of the times: the fifth problem.

_________________________

Two posts by Ugo Bardi on "The Limits to Growth"

Cassandra's curse: how the limits to growth was demonized

Peak oil and The Limits to Growth: two parallel stories

Other "Limits to Growth" posts:

Dennis Meadows - Economics and Limits to Growth: What's Sustainable? - By Gail the Actuary New World Model - EROEI Issues - Guest post by Delores García

Limits to Growth Article Worth Another Look by Dave Murphy